CLPMF: A Disruptive Service That Saves Time And Money For Businesses Depositing Cash And Replenishing Notes & Coins

OTC:CLPMF | TSXV:CLIP

Clip Money (OTC:CLPMF) (TSXV:CLIP) is an NCR-backed start-up based in Ottawa, Canada, and operating in Canada and the US. It is helping physical stores and businesses quickly, safely, and less expensively deposit cash into and replenish notes and coins from their banks. Today it does this by installing a ClipDrop box in a mall, big box store, grocery chain store, or other central location for multiple retailers to use that interfaces with all banks. This way, the expenses associated with moving cash are shared by many businesses rather than by one, resulting in lower cost and effort. While Clip Money runs the system, it is partnered with operating companies such as Brinks and NCR which provide the hardware, maintenance, and cash collection for the ClipDrop boxes, and NCR Atleos for the Clip-enabled ATMs. We believe this is the first significant innovation in moving cash in 50 years.

Clip Money’s offering is unique as it allows deposits into any bank which can solve a problem, particularly for large chains. Store employees might either have to drive significant distances to reach a branch of a particular bank or must set up sweep accounts in a closer local bank. Traditionally, employee of a business either physically goes to its bank branch (85-90% of stores) and deposits cash (either through a teller or by night drop boxes), or pays a Cash In Transit (CIT) service to come and get it. Using ClipDrop, that business has a closer, more convenient location which not only provides cost savings through employee labor hours and faster access to cash, it also should be safer. Another major benefit is a time-stamped digital trail of where the cash is at all times as the company uses RFID-enabled tracking of its bags combined with cloud-based technology to provide transparent and timeline information on a business’s cash. Clip Money can save each store location hundreds of dollars a month. Armored cars (if used), employee labor, and sweep account fees can cost a store $400-$800 a month versus the average $80-$150 per month charges paid to Clip Money.

ClipDrop locations are typically located in malls and the company already has signed agreements at the Tanger Outlets, Simons Malls, and Brookfield Properties, as well as the chain store Staples which houses 80 of the boxes. It is currently providing its service to customers in approximately 400 locations and is continually expanding throughout the US and Canada. It is also adding new services: one that will allow stores to deposit into NCR’s ATMs located in stores (Clip ATM) and another called Clip Change which allows customers to withdraw cash in specified coins and bill denominations and delivered by the US Postal Service.

The Company is Backed By NCR’s Cardtronics -- its Largest Shareholder and a Business Partner

The company’s stock was listed in May 2022 on the TSX Venture Exchange and the company currently trades at a $16.8 million market cap and $14.6 million enterprise value. It is currently at a $596,000 revenue run rate and has been ramping revenues sequentially as it adds customers and locations. Its revenues grew over 3000% year over year for the first nine months of 2023. Although there is seasonality in the business based on sales volumes, we believe that revenues should continue to ramp sequentially as onboarding of new customers compensates for sales volumes. On September 21, 2023, Cardtronics, Inc. (a subsidiary of NCR Corporation) invested US$10 million in the company by buying 28.6 million shares at CDN$0.23 per share for CDN$6.6 million and a CDN$6.8 million convertible note in a private placement at a $25 million pre-money valuation. Upon conversion, this represents a 40% ownership of NCR. The two now have a long-term, firmware-exclusive, collaboration that combines Clip Money’s cash deposit solution with NCR’s cardless cash deposit API and will allow Clip Money to use NCR’s ATM network. Cardtronics/NCR is now the largest common shareholder owning 27% of the company. NCR currently operates 2,500 deposit-taking ATMs across 30 states which serve more than 70 of the largest population centers in the US. These locations will be incremental to Clip’s current 400 locations comprising the ClipDrop network. The profit margin associated with using NCR’s ATMs is expected to be much higher than legacy ClipDrop usage as Clip Money will have no installation costs, cap ex, or fixed costs when using them.

How Big is The Potential?

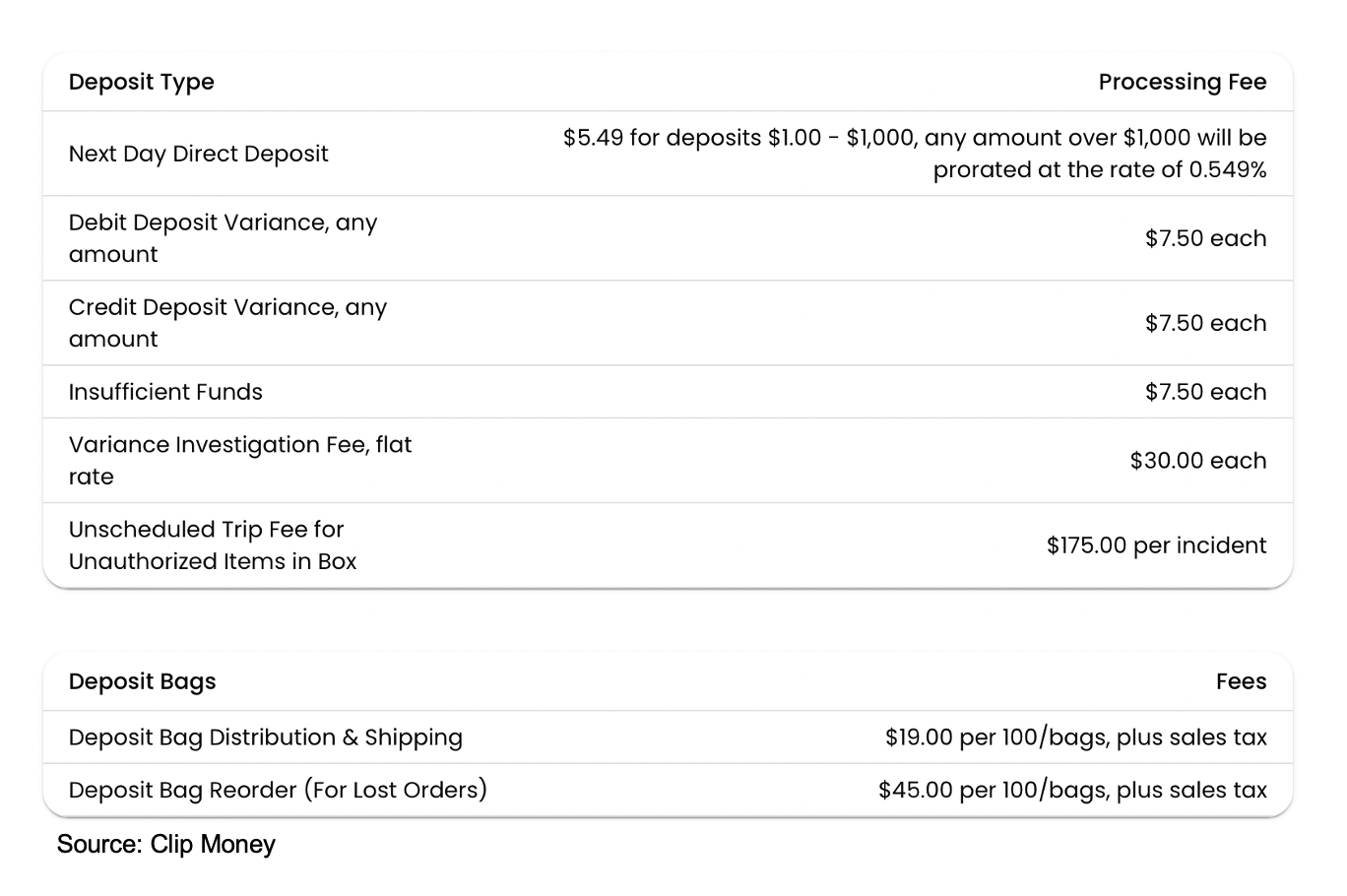

Believe it or not, the cash operations ecosystem is an $8 billion market in the US and its operations have changed little in the past 50 years. There are 3.8 million US businesses that take cash, and still today, approximately 30% of their transactions are with cash. Clip Money thinks it has the potential to generate $250 million in annual revenue based on a subsector of this market where the economics prove profitable. Clip Money generates revenue from each transaction a customer makes, and most customers transact daily. The customer is charged $5.49 per transaction up to $1,000 deposited and then another 0.549% of the deposited amount above and beyond. The fee is taken directly out of the deposit amount so Clip Money’s only accounts receivable from the larger customers who have asked to be charged every month instead of at each transaction. As a result, Clip Money has high visibility as it tracks its daily sales. Customers also pay fees for their deposit mistakes. The fee charges are shown in the following table:

The company claims the average store generates $100-$140 per month in revenue from Clip Drop deposits. It hopes that Clip Change, the new cash delivery product, could add another $80-120 per month and that most customers will use it.

What’s Next?

In addition to the ClipDrop, the company is now rolling out Clip Change which was introduced in Q2 2023 and began to generate revenues in Q4 of 2023. This service allows customers to request the cash they need in the coin and bill denominations they want. This cash is then delivered to their locations by US Postal Service. Interest has been so strong from current ClipDrop customers that the company has done little marketing and is working hard to get the service up and running where it already has demand.

Starting in 2024, investors should expect the rollout of Clip ATM. As a result of its partnership with NCR, Clip Money will allow customers to make cardless deposits using NCR’s already-installed ATMs that are located in top-tier pharmacies and retail stores. The company is still working on its integration and is in the testing phase. It has not yet started to beta test this with customers which would be the next step. By the end of 2024 management expects that 3,000+ of NCR’s ATMs will be available for use. Gross margins for the Clip ATM solution are expected to be in the 40-60% range compared to the capital-intensive Clip Drop solution which should yield 20-30%. This large pool of ATMs makes Clip Money a meaningful solution as it rivals the number of branches of the nation’s largest banks and finally makes bank branches obsolete for business banking transactions.

Near term the Q3 report evidenced continued growth in revenues. Three large national chain-store retailers added more stores during the quarter including Lids who added over 300 of their approximately 1,200 stores. Two others added 246 of their combined 1,200 stores and these additions continued in Q4. New stores that started initial rollouts in Q3 included a national mall-based apparel retailer with over 600 stores that piloted 15 stores using both ClipDrop and Clip Change Order and another 600-store retailer with a rollout to its first five initial stores and is also using both services. Given that Clip Money has experienced negligible attrition, these additional stores combined with the seasonal strong Christmas quarter portend exceptionally good growth for Q4.

Why Take a Look at Clip Money?

Although it has a long journey ahead fraught with risk, we believe investors should take a look at Clip Money. Given its short lifetime, its obscure listing on the Canadian Venture Exchange, low revenues, and no research coverage, most investors will have never heard of the stock. Its management does, however, articulate a compelling business model and evidences the economics to make its product offerings attractive to customers. The investment by NCR and the addition of the chief operating officer of NCR Atleos to Clip Money’s board in November almost assures investors of a deep pocket backing the company going forward and a desire by NCR to make the business successful. This combined with a first-mover advantage may put Clip Money ahead of any future competition. With a low float due to NCR and insider holdings, the stock may be hard to buy, but the stock and the company deserve a second look even if only for the fact that it is trading below the valuation price NCR paid in September.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives quarterly payments totaling a maximum fee of up to $40,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.